Raise in tax redemption, incentives, specific schemes to benefit infrastructure and manufacturing, investment in digital infrastructure, a policy that further encourages a sturdy start-up ecosystem through easier loan disbursements, e-approvals, and more are expectations of industry people from Budget 2023-24, set to be presented by Finance Minister Nirmala Sitharaman on February 1.

With the budget right around the corner, industry leaders have come up with specific demands as per their industry requirements from Budget 2023.

Tax relief is a major concern

Layoffs, reduced income, and the looming recession have brought discomfort to the people. With the upcoming budget, the working class hopes to have tax relief this year.

“In the post-pandemic era, people have either lost their jobs, have undergone salary cuts, or are battling inflation and EMIs. Such talent will expect a raise in the tax redemption by the government in the upcoming budget. It will be a morale booster for them to perform better under less financial burden,” says Richa Telang- CEO and Founder of TrueBlue Advisory.

It is anticipated that the government may provide tax breaks or other incentives to urge businesses to increase employee benefits. “The government may consider offering tax rebates or other incentives to businesses that hire more women by promoting a pleasant work environment. Businesses should focus on retraining and updating their personnel in order to enhance output, and the government must inform businesses of tax benefits for training or incentive-related programmes through the budget,” says Anshuman Das, CEO and Co-founder, Careernet.

Considering the ongoing job market scenario and the high possibility of a recession hitting India, this year’s budget is crucial, says Aastha Almast, Co-Founder & Chief Business Officer, The New Shop.

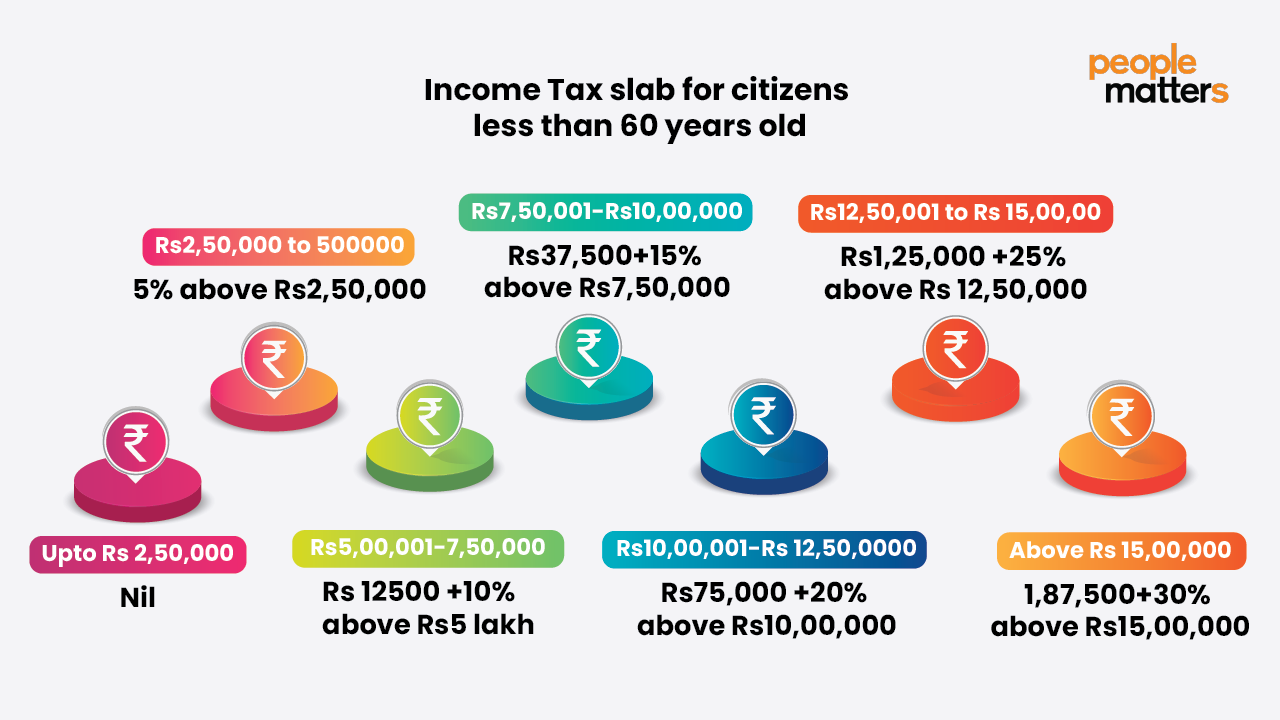

“The salaried class in particular has great hopes for the introduction of some tax relief in the tax slabs. They are expecting to enjoy long-term benefits like healthcare, superannuation, maternity post-retirement benefits. The section 80C deduction cap (currently Rs. 150,000) is also anticipated to increase. The move, if it fructifies, may leave more disposable income in the hands of consumers.

Measures to accelerate job creation and broaden the tax base by rationalising GST and personal income tax slabs to boost consumption are other expectations of Aastha.

On the other hand, Rajeev Sharma, Chief Strategy Officer, Mitsubishi Electric India Pvt. Ltd expects increased focus on infrastructure and technology sectors.

Upward investment in infrastructure and technology sectors

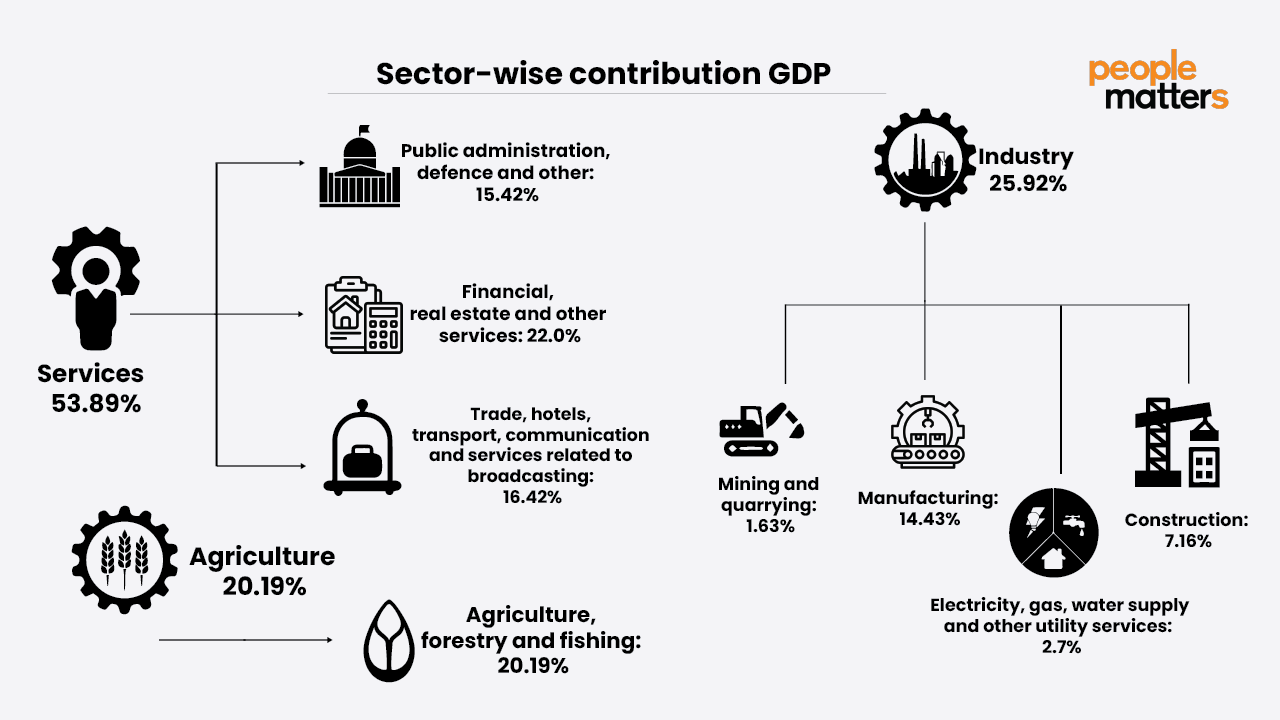

“I hope that Budget 2023 scales a path towards India’s growth story, especially in the infrastructure and technology sectors. The expectation for the upcoming union budget is to continue and provide the right policy and budgetary framework to ensure the economic growth of the country and a budget design that can stand as per the GDP growth rate expectations. Considering that the Indian economy has begun to recover from the fiscal repercussions of the COVID-19 pandemic outbreak, the manufacturing sector is expected to experience solid growth, which can further strengthen by providing fiscal incentives and specific schemes in the upcoming union budget 2023-24,” says Sharma. He bats for encouraging manufacturing investment among technology providers to bring self-reliant solutions to the country.

“Development of new-age manufacturing skills across the top and bottom of the pyramid must be enlightened which can be a game changer for further skill development. The overall expectation from the union budget is that it brings steady growth for the present and future of the country.

Currently, manufacturing accounts for about 15% of the country’s GDP.

Incentivise early-stage start-ups

Ganesh Nikam, Managing Director and CEO of Biojobz feels that incentivising retail investments into early-stage start-ups can be helpful.

“I would like to limit my budget wishes to two very important demands on taxation. Considering the holding period, ESOPs should be considered long-term capital gains (LTCG) for tax purposes and should only be taxed at the time of sale rather than at the time of exercise. To incentivise and increase retail investments into early-stage start-ups, tax credit upto to Rs 5 lakh from personal taxable income for any investment loss in recognised start-up and deferring of capital gains in case it is reinvested again in start-ups or any SEBI recognised funds.”

Sandhya Bollam, Vice President – HR, Liminal, a digital wallet infrastructure platform, wants heavy investment in digital infrastructure to create a strong foundation for a thriving digital economy.

“The digital economy is capable of generating mass employment in domains such as tech operations, cryptography and blockchain roles. In India, approximately 65 lakh graduates pass out every year and providing jobs to every skilled individual is a mammoth task. We should actively work towards an entrepreneurship-driven economy where every entrepreneur generates employment for fresh graduates,” says Sandhya.

Policy is needed to encourage a sturdy start-up ecosystem

Despite pandemic-induced inflation, the nation witnessed flourishing entrepreneurial ventures as a consequence of early-stage acceleration and venture capital, as well as a push from the gig economic model to initiate and prepare businesses for the future of work.

Vidyarthi Baddireddy, CEO and Co-founder at PickMyWork, says that given the prospects the urgent priority of the hour is to devise a policy that further encourages a sturdy start-up ecosystem through easier loan disbursements, e-approvals, and more government-led incentives in India’s tier-I and tier-II cities.

“Although the Fund of Funds for Start-ups (FFS) has played an integral role in mobilising domestic capital in the Indian start-up ecosystem, government interference should occur directly in this respect to ramp up the start-up perks being offered, particularly for early-stage start-ups. Moreover, the government should also recognise relieving angel tax constraints in Budget 2023, as start-ups are frequently in the early stages of their growth and may not generate the same level of income or revenues as established businesses. Taxing the funds start-ups secure from investors may demotivate them from advancing creative solutions and developing new technologies.”

Industry people feel that in the present Budget, it is imperative that the government holistically assess the needs of the start-up community and prioritise the development of an ecosystem that fosters growth for the community. As the funding winter for start-ups is said to continue for another 12 to 18 months, a more favourable capital gain tax system is needed to encourage easy access to capital. The government should also consider tax exemptions in FDI and maintain a sharp focus on start-up infrastructure development”.

Vikram Ahuja – Managing Director, ANSR and Co-founder & CEO, Talent500, says that India is home to over 1500 Global Capability Centers (GCCs), earning itself the title of the ‘GCC capital of the world’. “One of the key reasons why MNCs set up their GCCs in India is the robust start-up ecosystem the country offers. As innovation has emerged as the primary focus area in GCC strategy, start-up collaboration gives GCCs access to newer technologies that can help further the innovation agenda of the enterprise. With GCC revenue expected to scale up to $60-$85 billion by 2026, it is important for the government to take prudent steps to help start-ups, thus creating a more fertile soil for GCCs.”

Increased budget allocation for AYUSH research

In view of the uptick in consumer acceptance of Ayush for preventive, traditional medicines in the post-covid era, Ameve Sharma, Co-Founder, Kapiva, feels there should be a greater increase in the budget earmarked for research grants in the field of Ayurveda, to foster innovation through government & industry collaborations, as the millennial consumer looks for proof of clinical efficacy. Last year, Rs 3,050 crore was allocated to the Ministry of Ayush to promote preventative healthcare.

Digitisation of SMEs

Vijay Yalamanchili, CEO of Keka – HR tech platform for SMEs says, “The SME segment employs about 40% of the total workforce but contributes only around 17% to the GDP. SMEs have the capability to induct a significant part of people entering the workforce every year. Digitisation of SMEs will play a key role in uplifting the entire ecosystem and boost unprecedented growth. Tax rebates for SMEs investing in business software is one of the key things that I would like to see in the budget. There are a couple of countries that are doing this such as Singapore, I believe it’s time that we should have it in India as well.

He further adds that employees are overburdened with the current tax structure and thus from this year’s budget a reduction in taxes for the employees can be expected.

Additionally, the PF rates can also be increased to incentivise the employees to save more. “A boost in the HRA to accommodate the high rentals and office work set up costs post covid is also expected in the budget 2023,” says Yalamanchili.

Women-led entrepreneurial eco-system

In the year of India’s G20 Presidency, Nidhi Bhasin, CEO, Nasscom Foundation wants the government to prioritise women-led entrepreneurial development and build a strong ecosystem for nurturing the youth to help accelerate India to become the world’s third-largest economy.

“As India stands poised to reach its target of hitting the $5 trillion mark, there is still a sizable quantum of work required to especially bridge the digital divide prevalent in the country. By facilitating deeper penetration of digital literacy and tech-based skilling, the government can ensure greater involvement of women and youth from marginalised and underserved communities to contribute to the economic growth trajectory of India. Additionally, implementing R&D work and promoting collaboration between the government and the social sector will help achieve India’s sustainability goals by 2030,” adds Bhasin.

Incentivise the adoption of new-age technologies

The upcoming Union Budget will be crucial in strengthening and safeguarding the Indian economy from the slowdown being experienced by other countries globally. “We expect the government to incentivise the adoption of technologies like automation, Artificial Intelligence (AI), and robotics in sectors like manufacturing, governance, and BFSI to bolster the agenda of a Digital India and Make in India,” says Arun Balasubramanian, Vice President and Managing Director India and South Asia, UiPath.

Moving forward, automation is going to be a business imperative and an important skill to have for both organisations and individuals. “Keeping this in mind, the budget should account for investments in skill development for new-age technologies. Like the Production Linked Incentive (PLI) scheme announced in the previous budget, the government should consider a Skill Linked Incentive (SLI) scheme to build a digital and future-ready workforce. The scheme could be the incentive needed for companies of all sizes to invest in the upskilling of their employees, to be able to ride the next growth wave of the digital economy,” adds Balasubramanian.

Comments are closed.